{Epistemic Status: Mostly straightforward analysis, partially inspired by/riffing on this paper I saw a few years ago. Other than the brief section on public goods, all constructions are my own. This should mostly be treated as a modeling exercise.}

Economics is often criticized for having an overly narrow conception of human behavior and for caricaturing people as unrealistically selfish automatons. An especially common place where these objections appear is when discussing collective action problems since critics feel like defecting in these games is unintuitive.

Having studied economics in some depth, I think these critiques are mostly just caused by the difficulty of imagining a ‘True Prisoner’s Dilemma’ where participants genuinely don’t care about each other’s suffering.1 Still, if people find empathy more intuitive than non-empathy, it is worth asking how empathy actually affects economic models.

Maximal empathy

To see the effect of empathy on our models, we can first examine the extreme case where every person cares just as much about each other individual as themselves. Here, it is trivially true that social welfare is maximized, which means that all incentive problems are solved and all externalities are fully internalized.

This result is not particularly remarkable, but it does show that empathy can substantially affect the outcomes of economic models.

Degrees of empathy

If we move away from the simple case of perfect empathy, we can see some mostly intuitive results of limited empathy in economic models of public goods, market externalities, bargaining, and the prisoner’s dilemma.

Public goods

Public goods are generally under-provided because most of the benefit of the public good goes to those who do not pay for it. The private gain from paying for the good is always less than the public benefit, so public benefit will not be fully achieved.

Introducing empathy into this problem intuitively closes the gap between public and private benefits and increases the supply of public goods. Indeed, any increase in the empathy displayed by any individual will result in an increased provision of the public good (paper). Taken to the extreme, an individual with a sufficient degree of empathy would be willing to fund the public good entirely by themselves.

This result seems especially relevant to knowledge-creation activities, such as funding journalism, founding universities, creating inventions, and writing open software, which are often explicitly motivated by their public benefit.2

Market externalities

The effect of empathy on market externalities is very straightforward.. Essentially, market participants internalize the externality in proportion to their degree of empathy. An individual’s marginal benefit or marginal cost decreases/increases by the marginal negative/positive externality, discounted by the degree of empathy. This empathy correction can occur on the supply side or the demand size (or both).

At the individual level, this plausibly motivates some degree of ‘marginal charity’, where a producer might intentionally incur a small increase in supply costs for the sake of an outsized benefit to others that the producer cannot capture. It is also a possible explanation as to why some markets might not be fully profit-maximizing (at least until private equity starts running them3) and why consumers engage in boycotts.

Bargaining

Bargaining is an extremely complicated topic, with many different models. For the sake of simplicity, we can just consider a very simple example.

First, we can look at the basic cooperative bargaining problem. In this game, there is a surplus of z split between the two players, who each have utilities equal to the surplus they receive. If they don’t agree on a split, then they both get nothing. In this simple version, there is a Nash equilibrium for every division of the surplus between the two players.4

Interestingly, the addition of empathy to this game has no effect whatsoever since the payoffs are zero-sum and gains are always at least as large as empathized losses (assuming empathy discount rate <= 1).

Still, even if the basic model does not seem to reflect our intuitive expectations for the effects of empathy, we can adjust it to get more reasonable results. In particular, we will change the utilities of both players to include diminishing returns:

So far this change is pretty minor. In fact, each player’s ranking of outcomes (absent empathy) remains exactly the same, so the set of Nash equilibria also remains exactly the same. However, once we reintroduce empathy, the results start to better match our expectations:

In particular, we can calculate the marginal utility curve of an empathetic player w.r.t their surplus and see that it goes negative for values greater than z/(alpha + 1). As a result, the set of Nash equilibria shrinks with increases in empathy.

As we can see in the graph above, the more empathetic a player is, the smaller the share they are willing to accept becomes, ultimately converging to at most a 50-50 split. When playing against a selfish player, this plausibly means that the empathetic player will get less than they would have if they were less empathetic.5

If both players are empathetic, then the set of Nash equilibria is squeezed on both sides until players split the surplus evenly:

I think this kind of bargaining, where individuals have some level of empathy for each other, is much more realistic for many social, familial, and romantic relationships than the non-empathetic version. It also plausibly matches the common qualitative characterization of relationships as ‘transactional’ (low or zero empathy) or ‘non-transactional’ (high empathy).

Prisoner’s dilemma

Examining the effect of empathy on the prisoner’s dilemma is somewhat different from the previous examples. In particular, the simpler and more discrete actions mean there is less room for continuous adjustment. Either it follows the pattern of a prisoner’s dilemma or it doesn’t. For example, if players have perfect empathy, then (Defect, Defect) stops being the only Nash equilibrium and the game is no longer a prisoner’s dilemma.6 This possibility raises the question of whether, for a given level of empathy, there even can be a prisoner’s dilemma, given we know this is not true for perfect empathy.

To analyze this, we can define the Prisoner’s Dilemma as a symmetric 2x2 game where the payoffs are:

And where the payoffs follow these inequalities/constraints:

If these apply, then the strategies, incentives, and equilibria are the same as the prisoner’s dilemma.

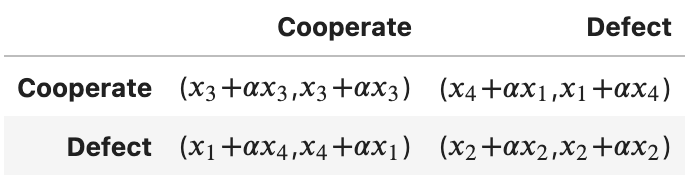

Now we can define an Empathetic Prisoner’s Dilemma with these payoffs:

And following these inequalities/constraints:

If we analyze this mathematically, then we can find a simple set of values/functions that can guarantee an Empathetic Prisoner’s Dilemma for any level of empathy in the range [0, 1).7

I think this result is pretty interesting since it demonstrates that prisoner’s dilemmas (and likely many similar games) are not just artifacts of an extremely selfish society, but rather fundamental problems that any plausible group of people will likely have to face.

Final thoughts

There are a lot of simplifications made in the models above (e.g., players are assumed to know each other’s payoffs, and empathy is assumed to be uniform across people), but I think they do a good job showing both how economics is flexible enough to incorporate ideas like empathy and how standard economic models/conclusions remain relevant, even with empathy.

For similar applications to voting I recommend ‘Is Voting Important’ (80,000 Hours, serious) and ‘Your Vote is Worth Exactly $1730.27’ (Youtube, more fun).

{Code used to generate diagrams, etc. is available at https://github.com/ohmurphy/empathy_econ}

Difficulty imagining/endorsing selfishness in the abstract here does not necessarily translate into empathetic actions in the real world. Instead, I expect it likely just reflects hypocrisy.

The degree to which such activities are actually motivated by public benefit is not always clear, but I expect that concern for the public is a real and important factor.

This is more plausibly a principal-agent problem, but I haven’t analyzed the effect of empathy on that model, so I put it here instead.

For x1 + x2 = z, player 1 commits to x1 or else they both get 0. Then player 2’s best response is to accept (i.e., commit to x2). If player 2 commits to x2, player 1’s best response is to commit to x1, so this is a Nash equilibrium.

This is not guaranteed since they could just always choose 50-50 regardless of empathy, but intuitively this seems correct.

Assuming perfect empathy [U(outcome) = U1(outcome) + U2(outcome)], if U(Cooperate, Cooperate) > U(Defect, Cooperate) = U(Cooperate, Defect), then (Cooperate, Cooperate) is also a Nash equilibrium. If U(Defect, Cooperate) = U(Cooperate, Defect) > U(Cooperate, Cooperate), then (Defect, Cooperate) and (Cooperate, Defect) are both Nash equilibria.

Proving these values/functions work is easy since you just need to verify the inequalities hold.

Great read! Really enjoyed the addition of the empathy element to the standard prisoner's dilemma.

Also, I second the first part on that economics is often perceived as extremely rational. Funnily enough, one of my recent posts focused on the fact that in cooperative games, it appears people do not know how people will react in equilibrium leading to 'irrational' outcomes. (the paper here - https://academic.oup.com/restud/article-abstract/85/2/964/3807118 ; my article here: https://www.nominalnews.com/p/demand-bad-policy-elections )